What is GST??? Is it Good or Bad?? Explained for Beginners

Goods & Services Tax is a comprehensive, multi-stage, destination-based tax that will be levied on every value addition.

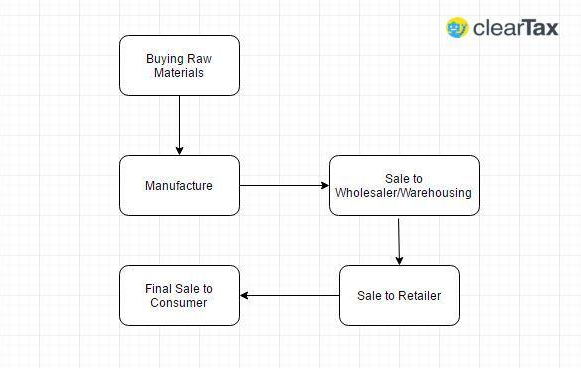

Let us start with the term ‘Multi-stage’. Now, there are multiple steps an item goes through from manufacture or production to the final sale. Buying of raw materials is the first stage. The second stage is production or manufacture. Then, there is the warehousing of materials. Next, comes the sale of the product to the retailer. And in the final stage, the retailer sells you – the end consumer – the product, completing its life cycle.

Goods and Services Tax will be levied on each of these stages, which makes it a multi-stage tax.

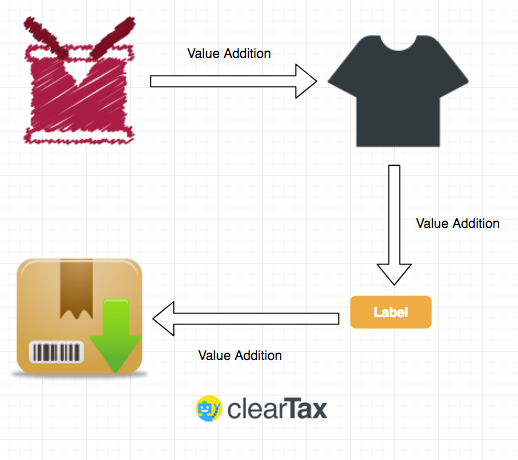

Let us talk about ‘Value Addition’. Assume that a manufacturer wants to make a shirt. For this he must buy yarn. This gets turned into a shirt after manufacture. So, the value of the yarn is increased when it gets woven into a shirt. Then, the manufacturer sells it to the warehousing agent who attaches labels and tags to each shirt. That is another addition of value after which the warehouse sells it to the retailer who packages each shirt separately and invests in marketing of the shirt thus increasing its value.

GST will be levied on these value additions – the monetary worth added at each stage to achieve the final sale to the end customer.

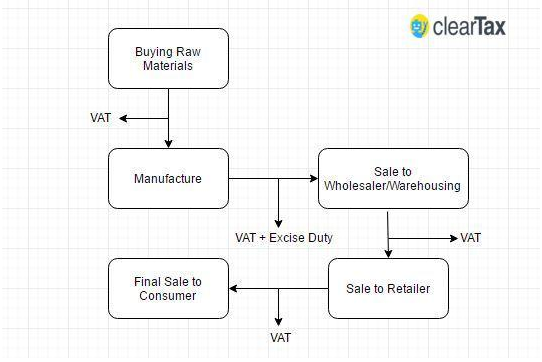

We need to talk about Destination-Based. Goods and Services Tax will be levied on all transactions happening during the entire manufacturing chain. Earlier, when a product was manufactured, the centre would levy an Excise Duty on the manufacture, and then the state will add a VAT tax when the item is sold to the next stage in the cycle. Then there would be a VAT at the next point of sale.

Now, Goods and Services Tax will be levied at every point of sale. Assume that the entire manufacture process is happening in Rajasthan and the final point of sale is in Karnataka. Since Goods & Services Tax is levied at the point of consumption, so the state of Rajasthan will get revenue in the manufacturing and warehousing stages, but lose out on the revenue when the product moves out Rajasthan and reaches the end consumer in Karnataka. This means that Karnataka will earn that revenue on the final sale, because it is a destination-based tax and this revenue will be collected at the final point of sale/destination which is Karnataka.

How will GST help India and common man?

| Action | Cost | 10% Tax | Total |

| Buys Raw Material @ 100 | 100 | 10 | 110 |

| Manufactures @ 40 | 150 | 15 | 165 |

| Adds value @ 30 | 195 | 19.5 | 214.5 |

| Total | 170 | 44.5 | 214.5 |

This is called the Cascading Effect of Taxes where a tax is paid on tax and the value of the item keeps increasing every time this happens.

But in GST,

| Action | Cost | 10% Tax | Actual Liability | Total |

| Buys Raw Material | 100 | 10 | 10 | 110 |

| Manufactures @ 40 | 140 | 14 | 4 | 154 |

| Adds Value @ 30 | 170 | 17 | 3 | 187 |

| Total | 170 | 17 | 187 |

In the end, every time an individual was able to claim Input tax credit, the sale price for him reduced and the cost price for the person buying his product reduced because of a lower tax liability. The final value of the shirt also therefore reduced from Rs. 214.5 to Rs. 187, thus reducing the tax burden on the final customer.

So essentially, Goods & Services Tax is going to have a two-pronged benefit. One, it will reduce the cascading effect of taxes, and second, by allowing input tax credit, it will reduce the burden of taxes and, hopefully, prices.

Summary

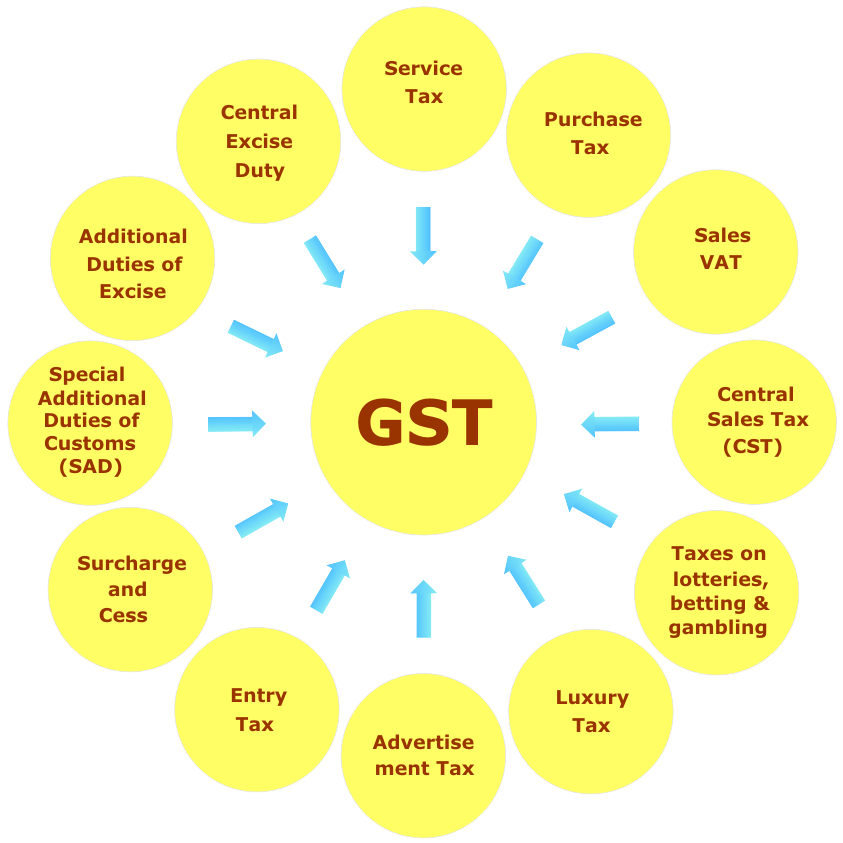

The idea behind having one consolidated indirect tax to subsume multiple currently existing indirect taxes is to benefit the Indian economy in a number of ways:

- It will help the country’s businesses gain a level playing field

- It will put us on par with foreign nations who have a more structured tax system

- It will also translate into gains for the end consumer who not have to pay cascading taxes any more

- There will now be a single tax on goods and services

In addition to the above,

- The Goods and Services Tax Law aims at streamlining the indirect taxation regime. As mentioned above, GST will subsume all indirect taxes levied on goods and service, including State and Central level taxes. The GST mechanism is an advancement on the VAT system, the idea being that a unified GST Law will create a seamless nationwide market.

- It is also expected that Goods and Services Tax will improve the collection of taxes as well as boost the development of Indian economy by removing the indirect tax barriers between states and integrating the country through a uniform tax rate.