GST Rate- The Winners and The Losers

The wait is over, Here comes GST

The GST Council has finalized four tax rates of 5%, 12%, 18% and 28% on services including telecom, insurance, hotels, and restaurants.

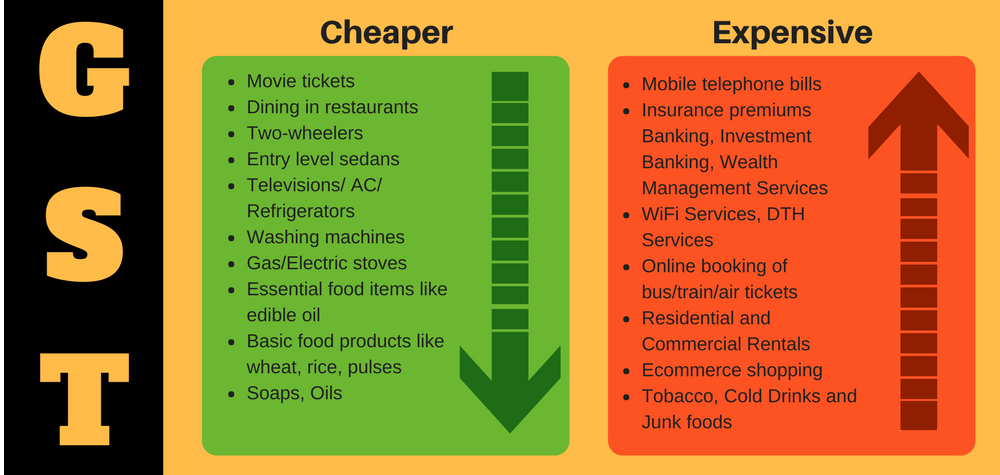

The government said the council’s focus was to keep the tax rate low on affordable goods or services, progressively raising it for those that can be counted as a luxury. GST will replace a bundle of indirect taxes imposed by the center and the states and is expected to bring down tax leakages.

Eating out at small restaurants and dhaba, hiring a cab or staying in a non-5 star hotel will be cheaper under the new Goods and Services Tax regime. Education, health and public transport will be exempt.

The Winners and The Losers of GST:

| SERVICES | GST RATES | LOWER OR HIGHER |

| Education | 0% | No change |

| Health | 0% | No change |

| Transport | ||

| Cabs like Ola, Uber | 5% | Lower |

| Metro, local train | 0% | No change |

| Non-AC train | 0% | No change |

| AC train | 5% | Lower |

| Air economy class | 5% | Lower |

| Air business class | 10% | Lower |

| Entertainment and leisure | ||

| Cinema | 28% | Lower |

| Eateries | ||

| Dhabas (With annual sales under Rs50 lakh) | 5% | Lower |

| Non-AC restaurant | 12% | Lower |

| AC restaurants bars | 18% | Lower |

| 5-star hotels | 28% | Higher |

| Hotels with tariff | ||

| Up to Rs 1,000/day | 0% | Lower |

| Rs 1,000-2,000/day | 12% | Lower |

| Rs 2,000-5,000/day | 18% | Higher |

| Above Rs 5,000/day | 28% | Higher |

| Telecom | 18% | Higher |

| Financial services | 18% | Higher |

The decisions came at the end of a two-day meeting of the GST Council headed by Union finance Arun Jaitley and which also includes his counterparts from states. According to the tax slabs approved by the council, small restaurants would be taxed at just 5 percent. But the rate progressively goes up to 12 percent for restaurants without an air-conditioner and 18 percent for those with an air-conditioner or a liquor license. Diners in restaurants located in five-star hotels will, however, have to pay a 28 percent tax.

It has been placed in the 18 percent category, up from the existing 15 percent that the telecom industry complained would make services pricier for subscribers. Phone bills also could go up once GST comes into force. Movie tickets have also been placed in the highest tax bracket but the government insists that it was still less than the combined service and entertainment tax in most states.

When asked by the media about the impact on mobile bills and other services in the 18% slab, Jaitley said, “Although the headline rate may appear higher (than the current 15% service tax), the actual incidence will be lower since companies will get input tax credit for goods that they use. If companies don’t pass on the benefits, we have the antiprofiteering clause.”

Mr. Jaitley also said the net effect of Goods and Services Tax will not be inflationary. The government on Thursday kept basic food items out of the tax net, processed food items will be charged between 12 and 28 percent. In some cases, such as aerated drinks, the council had cleared a 12 per cent cess in addition to the luxury tax rate of 28 percent.Education and healthcare will continue to be exempt from tax. The GST system will subsume the various Central and state taxes – such as excise, value-added (VAT), service, octroi, and entertainment – into a common all-India system, with transparency as one of its prime objectives.The government strongly argued that input tax credits will reduce the final tax burden and prevent services from becoming more expensive.

If companies do pass on the credit they get, government calculations indicate that inflation may decline by 2%. State finance ministers echoed the view that overall there will be no price rise.

“We have made sure that consumers don’t have to pay more. The net impact on the system will not be inflationary,” Jaitley said.